TCBOT

Cryptocurrency grading

Grading the different cryptocurrencies will help us to reach 2 goals.

The first one is to adapt the bot to trade only the class of asset above the level of security asked by the client. The second to enable the bot to build different baskets of currencies to invest on Middle/Long term. The composition of theses baskets depending on the level of risk accepted by the client. For example one could buy a basket of new altcoins hoping to get an hundred percent return on one of them whereas a safer investor would buy a basket composed buy the main cryptocurrencies and wait for the developpement of the sector.

HOW

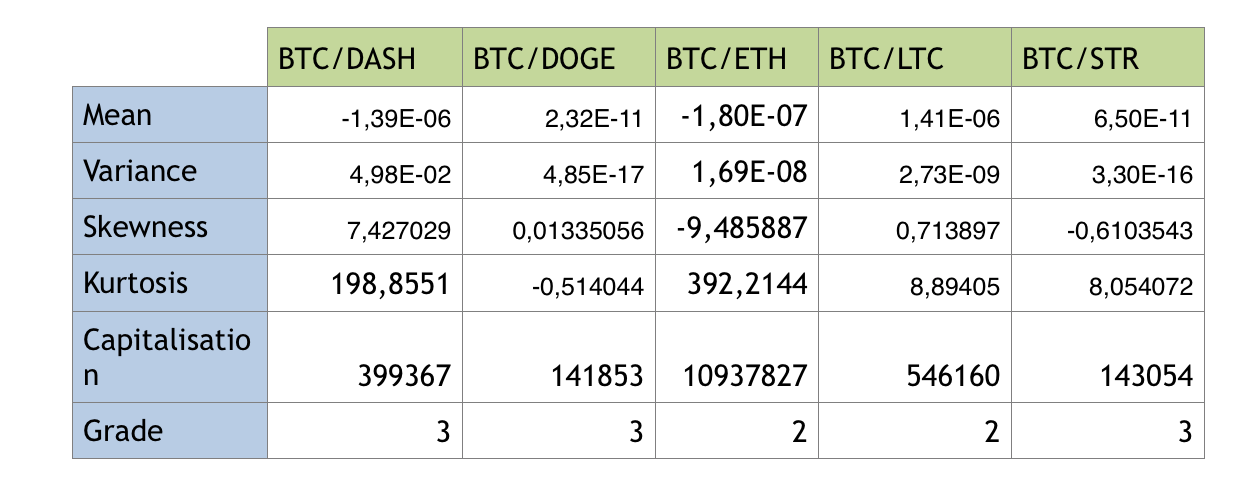

Our algorithm use historical data on 1 week interval to measure different estimations such as the capitalisation, some statistical tools (the mean, variance , skewness, kurtosis of the distribution) to “grade” each cryptocurrency as a quality of the asset in terms of risk. (The riskier being an asset with small capitalisation, high variance, and high kurtosis).

Spread

Goal

The spread is capital to evaluate the quality of an investment. Indeed the higher the spread is the riskier is the position as it is a sign of illiquidity of the asset and the position could fall a lot easily. But for a bot it’s also the possibility of making easy return by taking advantage of the hesitation of the market. Placing sell and buy order around the spread enables you to get the spread as long as the market don’t choose a trend.

Analysing the distribution of Bid & Ask, and measuring the market depth enable the bot to determine a target performance in accordance with the risk tolerated by the client.

Technical Analysis & Volume

Goal

After measuring risk and opportunity, the bot need to decide at which price place the order with accuracy. But whereas you can try to evaluate the right price of a stock by studying the activity of the company, its ratios etc… you can’t really evaluate the intrinsic value of a cryptocurrency.

Sold order after jump in volume&price / Buy order on the support

How

In this case Technical Analysis seems to be a good method to evaluate the right price to buy or sell the asset. For that we transcript the major rule of Chartism to be able to read the support, resistance, bullish channel, bearish flag etc…Counting top & low value indicate the major trend, resistance and support. The more x value you have the stronger is the resistance/support.

Short Term Bearish Channel on BTC/EUR

Arbitrage

As the cryptocurrencies are not as traded as the other assets, this market is not that efficient. It creates risk but also a lot of opportunities in terms of arbitrage between the different token.

You can see that move of BTC/EUR is +3.63% and BTC/GBP is +4.68% whereas ETH/EUR is +3.3% , ETH/GBP is +3.54% => Existence of arbitrage opportunity For exemple let’s consider you buy 1BTC , sell it for 2531.763 ether and then sell the ether. You would spend 2200£ and then get 2210.5£ so 0.475% for free ( In reality you’ll get less depending on your fee level)

Price and move over 24h of the cryptocurrencies traded on Kraken Exchange

Jump&Dive

Goal

With the low volume traded of these kind of asset (as a comparison with classical financial instruments). It happen regularly than one order “at the market” create a Jump/Dive by taking all the bid/ask available.

How

By studying the Bid&Ask distribution, the depth, the volume and the volatility, the bot will be able to let a “limit” order at a certain price under/above the current price to catch theses “free” opportunities .

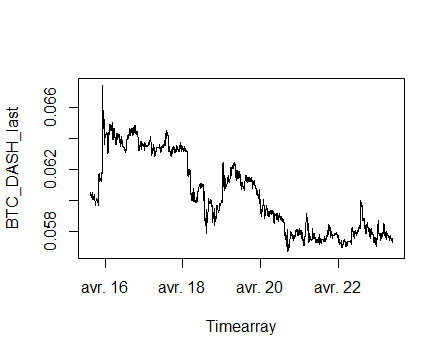

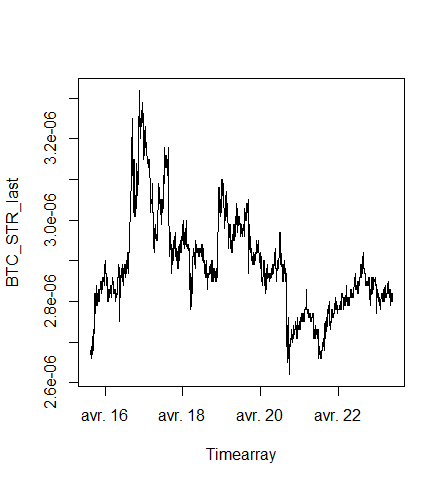

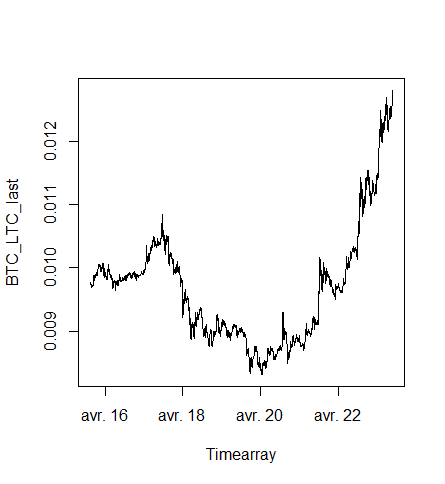

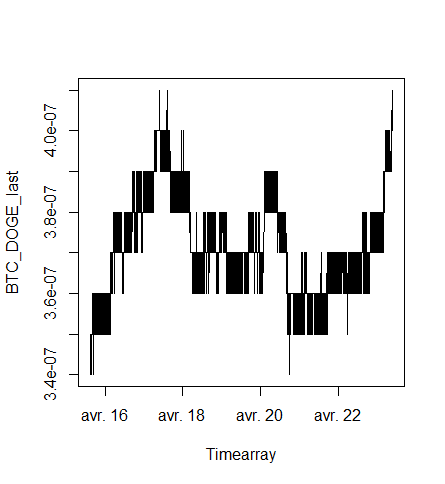

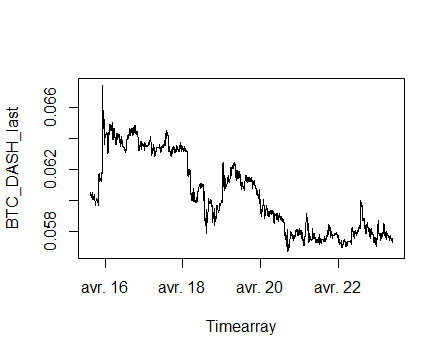

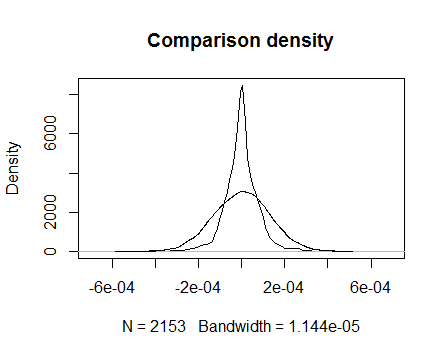

Some graphs